Ever since the Indy Racing League’s much anticipated announcement sketching out the strategy for the 2012 IndyCar chassis last Wednesday, the IndyCar community has been split. …again. …still. …whatever. There have been many that claim that the recipe of having a spec rolling chassis from Dallara and open development of the aerodynamic elements of the body work by teams and third-party manufacturers would lead to great innovation and involvement. Then there are those that think this is the worst type of policy that could have been proposed giving Dallara a tacit monopoly on the chassis construction once again. I’ll have a section at the end of this article linking to various sites arguing pro and con, and you can see the various opinions for yourself. Keep in mind that the articles that I include, whether they agree with me or disagree, I chose for their thoughtfulness, and well written, well reasoned arguments.

Initial Assumptions

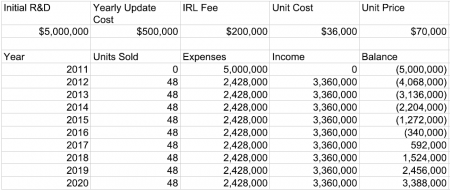

What I want to show you here are some numbers regarding the cost of the business of manufacturing aerodynamic body kits for the new 2012 chassis. Let me first issue the caveat that some of the estimates are rough, and I’ve tried to error on the conservative (profit-enabling) side of the equation.  Also, I make the assumption that a manufacturer is entering the game in order to be profitable and that they don’t have some external marketing motivation behind their work that would make running the aero kit operation at a loss worthwhile.

Also, I make the assumption that a manufacturer is entering the game in order to be profitable and that they don’t have some external marketing motivation behind their work that would make running the aero kit operation at a loss worthwhile.

The first and biggest cost for many entering the game isn’t the cost of buying a shop floor, autoclaves, and all the other necessary manufacturing infrastructure. We will assume that the company already has such equipment, is already well staffed, and ready to go. The initial cost of the venture will be the preliminary research and development of the shape of the kit. Computational physicists and engineers don’t work for cheap, and you won’t be able to pick up the tools of the trade, high-end supercomputers for CFD modeling and wind tunnels, down at the local BestBuy. Developing efficient and effective aerodynamics is a long, complex and most of all expensive process. Gordon Kirby recently posted an article in his The Way It Is column where he interviewed several key people from the other four companies that submitted proposals to the IRL. Take a look at Dan Partel’s comments.

“Do you have any idea what the costs are in doing an aero kit?” he [Partel] mused. “First of all, it takes a quarter of a million dollars to build a wind tunnel model. Then the Windshear rolling road tunnel in North Carolina costs $32,000 a day and I think it’s $20,000 a day for the Reynard tunnel in Indianapolis. So it’s going to add up very quickly to many millions of dollars.” Dan Partel, CEO Delta Wing Racing — Creating a new paradigm or tilting at windmills?, Gordon Kirby

Steve Charsley, USA Manager at Lola Cars International Ltd, also chimed in on the point of the cost of developing a body kit from the ground up, and he should know a thing or three about this business!

“If you’re going to get into it you’ve got to do it full-bore. If you do it half-baked you’re going to have an aero kit that’s inferior. So we’ve got to evaluate what the value is in us putting $5 million into an aero program to develop a kit. I’d like to think were going to do it with somebody in some type of partnership.” Steve Charsley, USA Manager at Lola Cars International Ltd — Creating a new paradigm or tilting at windmills?, Gordon Kirby

Thinking further on what kind of return there would be on the sales of these kits, keep in mind that the league has placed a price cap of $70,000 on the kits. If you could make them for a $1 a piece, then turning a profit would be significantly easier, but keep in mind that Dallara is selling their introductory 2012 aero kits for $36k. We’ll make the conservative assumption that the $36k number is selling at cost rather than at a loss. The number of kits sold will be the key number in determining whether a company will realize a profit or not. It would be ludicrous to assume that a single manufacture could shut out all others, including Dallara, so lets go with the rather optimistic number of selling to about a third of the grid, eight entries. For each entry on a well funded team, there is typically a primary and backup chassis and spare parts for both. That makes for four body kits per entry. Toss in two more body kits per entry to allow for crash damage and we’re up to 48 kits, total. That’s a lot. Even for KV Racing, that’s a lot, but we are trying to error on the side of profitability. Lastly, there will be the cost of continued development. If one is going to continue to sell kits that are competitive, this will be a vital component to the business model. Being safe, lets estimate update costs at 10% of the initial development costs at $500k per year.

Crunching the Numbers

We have our initial set of assumptions. Now lets run the numbers! The spreadsheet below shows the total expenditure and revenue during each year of the beginning in the development year of 2011 and extending through to eight years past the introduction of this new chassis, the same length of time the current chassis will have ran.

With these estimates, you’re not profitable until the sixth year of operation. Keep in mind that the contract with Dallara expires in 2015. In the third year of operation, there is still a net loss of a little over $2M. Here, I assumed flat sales. Of course, this will not be the case. The number of clients will fluctuate. Initially, the number of teams selecting a third-party kit will be low, given the huge advantage of Dallara’s at-cost pricing in 2012. If a company’s kit proves to be superior, then and only then will they attract a larger client base. This makes the first three years even more tenuous. Assuming success, beginning with a single two-car team, and by year three expanding to supplying half the grid, a company can move the switch over from being in the red to being in the black a year earlier. It still doesn’t help if the rules change in 2015 when the current Dallara contract expires.

Assessing the Results

Given the numbers above, I really don’t see how a viable business model can be built around the sale of aero kits for the 2012 Dallara rolling chassis. There is only one way this works, sponsorship. If there’s an additional marketing component to the business model, then the losses that WILL happen can be justified as a marketing cost. This is perhaps where Barnhart and others were going when the names of Boeing and Lockheed were repeated over and over during last Wednesday’s announcement.  There are actually a few companies that I could see gaining value from this. As Shaun pointed out in our 47th podcast, aka The Chassis Episode, Lotus could very well enter a body kit as part of marketing strategy through KV Racing Technologies. Its remotely possible that a mid-size manufacturer such as Stohr might find value in using IndyCar racing as a platform for generating sales of their WF1 D Sports Racer or F1000 open-wheel chassis. I will admit that the latter is a bit of a stretch. In the end, the numbers just don’t add up for any group to enter the aero kit fray without having some other product to sell. Making the body kits themselves can be considered a loss-leader product at best. Where does that leave us? We’ll see lots of Dallara kits, a Penske kit, a Ganassi Kit, and a Lotus kit. …maybe.

There are actually a few companies that I could see gaining value from this. As Shaun pointed out in our 47th podcast, aka The Chassis Episode, Lotus could very well enter a body kit as part of marketing strategy through KV Racing Technologies. Its remotely possible that a mid-size manufacturer such as Stohr might find value in using IndyCar racing as a platform for generating sales of their WF1 D Sports Racer or F1000 open-wheel chassis. I will admit that the latter is a bit of a stretch. In the end, the numbers just don’t add up for any group to enter the aero kit fray without having some other product to sell. Making the body kits themselves can be considered a loss-leader product at best. Where does that leave us? We’ll see lots of Dallara kits, a Penske kit, a Ganassi Kit, and a Lotus kit. …maybe.

Suggested Reading

- 20 More Years: The Dallara Century? The 2012 Indycar Announcement… — Dylan, Triple League Racing

- Initial reactions to the 2012 chassis strategy announcement — Stephanie Wallcraft, Planet-IRL.com

- And the Winner is … Cost Savings and Speedway, Indiana — Bill Zahren, PressDog.com

- Digesting Dallara’s victory — Christopher Estrada, IndyRacingRevolution.com

- The Paddock Pulse: 2012 Car-Pocalypse Edition — Tony Johns, Pop Off Valve

- The 2012 IndyCar: A Bevy Of Mixed Emotions — George Phillips, Oil Pressure

[…] This post was mentioned on Twitter by Doug Patterson, Openpaddock.net. Openpaddock.net said: New Content: OpEd – Selling 2012 IndyCar aero kits, can it really be profitable? – http://tinyurl.com/24xr5rh […]

I believe it will take millions to R&D a kit that works, X’s how many different manufacturers choose to participate. If they can nickle dime their way into a ROI, then my hats off to them. Moron Moraes gives them the best shot at turning profits. I’m skeptical as usual at this point . One kit will likely be far superior to the others thus forcing everybody to eventually go with the one that works, just to remain competetive, inevitably leaving us with more of what we have today. Multiple engine manufacturers may be what mixes it up… until the dominant prevails. Ford and Government Motors perhaps

REMEMBER: The only way to make a small fortune in racing is to start with a very large one.

Well said, ATB… But I think you’re missing something. Like you said, you must start with a small fortune, and whose got one? Penske! Being limited to just 2 packages a year, I think that we’ll start to see Penske developing new packages every year (and hopefully some others, such as Ganassi, Lotus, etc…). Yes, the big teams will be able to buy/develop new packages every year, but I think the cool thing will be when smaller teams (Panther, Dale Coyne, SFR, etc…) will be racing the last year’s package. This is a lot of what you saw back in the 60’s and 70’s. Not only did the teams announce what kind of car they were running, but what year it was manufactured in. This may not be how it plays out, but I certainly hope it is…

Thanks Remmy. One correction however, One must start with a very LARGE fortune to make a small fortune in Racing. The only way Penske will build bodywork is if there is money to be made. RP isn’t in the bidniz of losing money. He may be a good indicator as to the profitibility of taking on such an endeavor. If he does, then it is. If he don’t, then it ain’t. Believe me, RP is only half as rich as he was once upon a not so long ago time. Everybody is getting their arses kicked, and kicked, and waiting to get it kicked yet again.

Something we all may be missing… A further collapse of our economy may keep this thing from ever leaving the drawing board. There are still sad days ahead for a lot of folks. Things aren’t getting better, in fact, it is quite the opposite. Don’t shoot me, i’m just the messenger.

ATB, the problem is that Penske’s ROI won’t solely be dependent upon sales of the kits, but the ability of the Penske kit to outperform and dominate the competition. If Penske can create a dominant kit, then sponsorship of the Penske team will have greater value. That’s how Roger will make a return on his investment. That’s why I say there HAS to be an additional marketing component to the equation to make the aero kit game viable. As a product in an of itself, it’s a money pit.

If Penske racing did build kits and it was a winner and numerous teams bought them, then maybe it would help level the playing field. If half the field were running either a Penske/Dallara/Honda and the other half were running Ganassi/ Dallara/Honda, then I would say game on. As it is now in the current configuration, it is hard to tell just how good drivers like Wilson, TK, Hunter-Reay, and a few others really are. I believe Power, Wilson and Hunter-reay are among the worlds finest drivers. I also think that the current equipment make Dixon and Briscoe look alot better than they really are, They aren’t cut from the same fabric.

The only way to achieve that parody in the current state would be to outright ban Penske and Ganassi from Indycar. if they did that, there would be nothing wrong with what we have now. Any given team could win on any given sunday.

Racing as a whole is a loss leader. Ironically, except for on the bottom end of the spectrum NOBODY builds cars for a profit if they are in competition with others for a particular market. Which is why none of the proposals wanted any sort of competition. Doug makes a point about creating value for sponsorship of the Penske team. The same can be said about the entire F1 Paddock.